In April 2025, the UK government significantly increased Landfill Tax rates to discourage tax evasion and promote sustainable waste management practices. While rising costs may lead to some individuals or businesses seeking cheaper waste disposal options, it’s vital to be cautious. Many waste disposal companies offering ‘too-good-to-be-true’ prices are operating illegally and are often connected to serious criminal offences such as money laundering and drug trafficking.

The new Landfill Tax changes indicate a clear escalation in government efforts to curb waste crime. So, what risks should you be aware of and how can you protect your business from criminal liability? Phillippa Ellis, Fern Dempsey and Genevieve Forester explore below.

What is Landfill Tax?

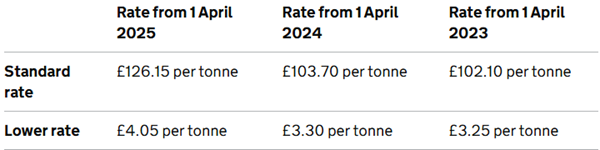

Landfill Tax is payable on material disposed of at landfill sites, whether the site is authorised and operating under an environmental permit, or unauthorised, where no permit exists. The tax is calculated by weight and applies at two different rates:

- the standard rate – applies to all other taxable material, including all disposals at an unauthorised site

- the lower rate – applies to qualifying fines and less polluting materials

Why has the government increased Landfill Tax rates?

The recent rise in Landfill Tax rates aims to:

- deter tax evasion, which ends up costing the UK economy billions of pounds every year

- encourage alternatives to landfill disposal, such as recycling and reuse

- crack down on waste crime, which is often linked to other serious criminal activity

The Environmental Services Association estimates that England’s economy loses around £1 billion every year to waste crime, and alarmingly, a 22.7% shortfall between the expected and actual Landfill Tax revenue points to widespread tax evasion. This could be happening through methods such as:

- misclassifying waste as lower-rate material

- underreporting waste volumes

- illegally dumping waste at unauthorised sites

Potential criminal liability

Individuals or businesses found to be evading Landfill Tax, or assisting in its evasion, might be referred to HMRC for tax fraud investigations. Those who knowingly cause or permit waste disposal at an unauthorised site could be liable for the unpaid tax and could face criminal prosecution. This liability could extend to:

- company directors or partners

- employees making decisions about waste disposal

- landowners whose property is used for illegal dumping

- businesses who fail to carry out due diligence on their waste contractors

Crucially, ignorance is not a defence. If your business benefits from discounted disposal rates without verifying the legitimacy of the waste disposal service, you could still be held liable. If you’re already involved in the material supply chain or you’re new to the movement or disposal of material, then you’re expected to be aware of and compliant with the Welsh Government’s Duty of Care requirements.

How can you protect your business from Landfill Tax fraud?

While discounted rates may seem appealing, they often carry the hidden risks of unexpected tax bills and potential criminal liability. To protect your business from exposure to these risks, you should remain vigilant against criminals posing as legitimate waste disposal companies.

There are several proactive steps you can take to ensure your business doesn’t knowingly cause or facilitate the disposal of material at an unauthorised site. You can:

- check that the next material holder is authorised to take the material

- ask the next material holder where they’re going to take the material and try to get proof

- give an accurate description of the material when it’s transferred to another person

- as a company director or partner, you can make sure you’re directly involved with decision-making regarding the disposal of material by that business

- as a landowner, make sure that any lease or rental agreements state what the premises or land may or may not be used for

- as a corporate body, include procedures within your company’s risk assessment to prevent Landfill Tax evasion through your business

This is not an exhaustive list and businesses are strongly encouraged to seek legal advice tailored to their specific situation.

The new Landfill Tax rates are a clear signal that authorities are increasing their scrutiny on waste crime. With serious penalties for non-compliance, carrying out due diligence has never been more important.

How can we help?

If you’re concerned about potential liability or you need support in navigating the recent changes, our experienced Business Crime and Investigations team is here to help.