Regulatory

When you become a client of the firm, we need to verify your ID. This page explains why we need your ID, how we keep your data confidential, and which documents you need to provide. If you have further questions, please contact our Client Opening team.

We have a responsibility to act in your best interests at all times. Part of that responsibility is to ensure that you are protected from fraud and criminal deception such as identity theft. In order for us to do this we need to be satisfied that your credentials are genuine before we can act for you.

Yes, all lawyers are required to request ID from their clients, prior to accepting an instruction. Put simply, all sorts of transactions require an individual to provide proof of identity. Accessing legal services is no exception, regardless of the provider you choose.

ID checks are necessary to comply with Anti-Money Laundering regulations. These regulations are designed to prevent money obtained by criminal activity from being filtered through recognised channels (such as a lawyer’s bank account) in order to legitimise and launder it.

Lawyers in England and Wales are regulated by the Solicitors Regulation Authority (SRA), our professional association. If our lawyers fail to follow the required procedures regarding identity checks they face serious consequences, which include being suspended from practice or ‘struck’ off the roll of solicitors.

No. You can use our online ID Service, called Credas. Please note the onboarding authorisation comes from Credas, which is managed by a third-party supplier CreditSafe.

This allows you to complete your identity verification at any time via a mobile, app, or in-browser, through our online identity checking portal.

Yes. Any ID provided will be held confidentially and in line with our GDPR obligations. All data is stored in the UK using Microsoft Azure Cloud, a globally recognised, secure and trusted platform.

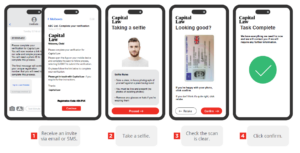

Our ID checking is fast and simple: Send, snap, scan and submit. That’s it. You will need to take a selfie, followed by a photo of your valid ID document.

Any checks that we make will result in a ‘soft footprint’ on your credit file which you will be able to see. It will not, however, affect your credit rating.

Our online ID service is secure, quick, and easy to use, enabling you to verify in less than a minute.

For business clients, lawyers are required to identify beneficial owners and controllers.

Limited companies must provide evidence of the identity and address for at least one director, as well as a list of the names and addresses of senior shareholders.

In the case of a partnership, a list of all partners is required, as well as evidence of identity and address for at least two of the partners. In addition, a copy of the current partnership deed or other document that confirms who owns the business must also be presented.

If you are struggling to provide the necessary ID, for example you don’t have either a passport or a driving licence, there are other options open to you.

Please contact our Client Opening team at the earliest opportunity and they will guide you through the next steps.